We have had a good look through the Federal Budget 2023 with you in mind. Below are the proposals we think are most likely to affect you or be of interest.

For You and Your Family

HECS-HELP debt

The Government will limit indexation of the Higher Education Loan Program (and other student loans) debt to the lower of either the Consumer Price Index (CPI) or the Wage Price Index, from 1 June 2023 and will be applied retrospectively.

Energy bill relief for Households and Small Business

An extension to the bill relief fund, all Australian household will get $300 rebate on their power bills, and eligible small businesses will receive a $325 rebate, paid on 1 July 2025

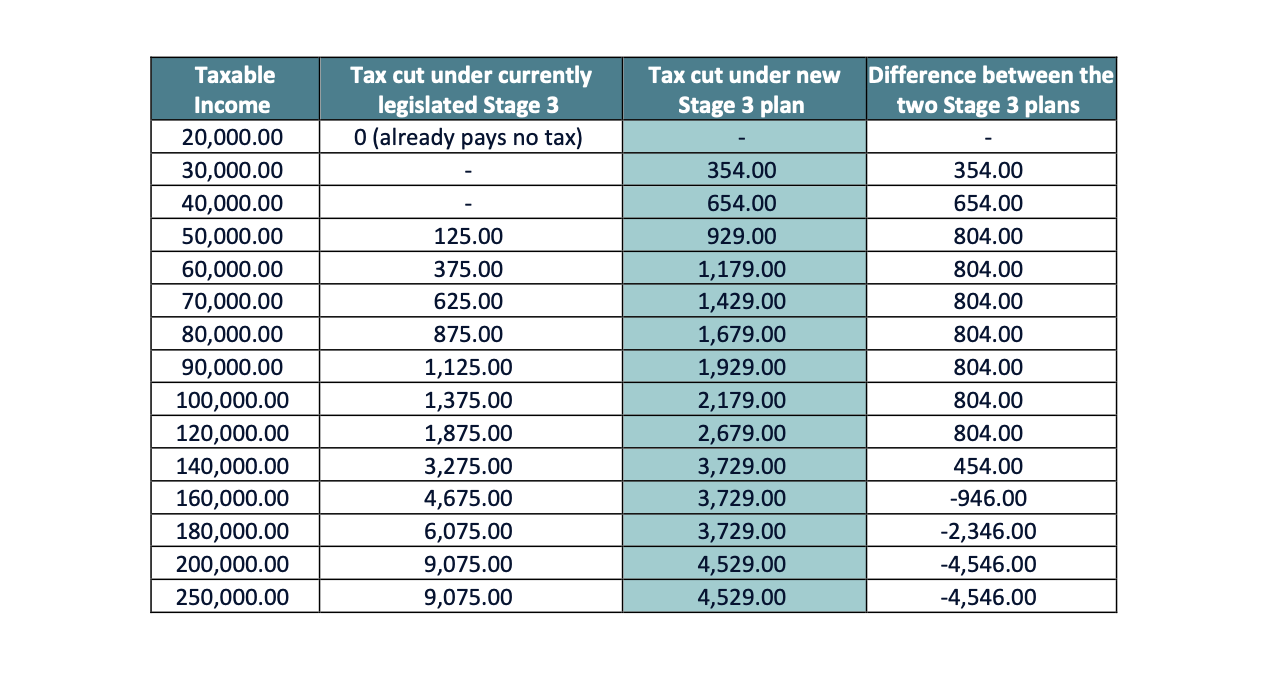

Stage 3 (revised) Personal Income Tax Cuts

As we have discussed in a previous newsletter, the planned stage 3 tax cuts come into effect on 1 July 2024. The figures included in “Tax cut under new Stage 3 plan” are the actual tax savings to you (per annum) at each income level when compared with the current financial year’s tax rates.

Business

Business

Instant Asset Write off

The $20k instant asset write off for small business has been extended to 30 June 2025. Assets that are first used or installed for use between 1 July 2024 and 30 June 2025 will be eligible.

Superannuation

Superannuation on Paid Parental Leave

Superannuation will be paid on top of Commonwealth-funded paid parental leave from 1 July 2025.